In most circumstances, the driver responsible for causing the crash pays your medical bills in a Virginia car accident. However, this may not always be the case depending on the situation.

That’s why it is important to hire a Charlottesville car accident lawyer who can pursue the compensation you need to get your life back on track. Our lawyers have 300 years of combined legal experience.

The At-Fault Driver is Generally Liable for Your Medical Bills

Virginia is an at-fault state for accidents. That means that the driver who caused the accident must pay for your medical bills and other losses.

This compensation generally comes from their insurance company and is paid out to you in the amount you are entitled to receive. Before damages can be paid out to you, though, liability must be determined in the claim.

The at-fault driver’s insurance investigates the accident. It will evaluate the actions of all parties to verify that the driver was actually at fault. This is likely to take time. Additionally, insurance companies want to pay as little as possible. They may try to shift the blame to you so they don’t have to pay your medical bills in Virginia.

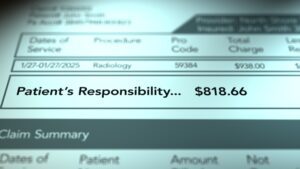

What is important to understand is that a wrongdoer’s insurance company will typically make only a one-time payment to cover your medical expenses.

That means they will not pay the bills as they are incurred. Rather, they will seek to make a lump sum payment, and they will usually try to do that before you have completed your medical treatment, while your injuries are still bothering you, and before you know whether you will have any complications in your healing process.

It is critical to know that you will have one opportunity to resolve your case. If you settle the case and you later find out that your injuries were much worse than originally thought, you will not be able to get more money from the insurance company.

When insurance adjusters assess fault, they will look at four components. The first is the duty of care that the driver owed to other motorists. The second element assesses the actions that breached that duty of care, while the third draws a connection between the actions and the resulting accident and injury. Finally, once liability is established, the at-fault party must pay.

For a legal consultation with a personal injury lawyer, call (434) 817-3100

Your Health Insurance May Provide Financial Relief Faster

You are not likely to receive a payment for your medical bills right away after your Virginia car accident. The investigation and negotiation process takes time, and insurance companies may cause intentional delays to avoid paying you.

As such, it may be in your best interest to get your own health insurance company to cover medical bills you receive before a settlement payment.

This compensation can help cover your immediate medical expenses. The specific costs and the extent of care may vary depending on your health insurance policy.

You will still have to meet applicable deductibles as specified by your plan to maintain normal financial responsibility. Be sure to have all service providers bill your health insurance after a car accident.

Medical providers may also apply a medical lien (§ 8.01-66.2.) to reimburse them if you are awarded money. But there are certain steps those medical providers must take and you must receive a written notice (§ 8.01-66.5.) to alert you before any action is taken. A skilled lawyer guides you through these challenging matters.

Medical Payments Coverage (MedPay) can be Beneficial for Covering Your Medical Bills

MedPay is another type of insurance coverage that may pay your medical bills after an accident, depending on the options available to you. Eligible expenses included medical care, rehabilitation, hospital costs, surgeries, and other emergency-related expenses. It may also help pay up to $100 a week of lost income if your injuries prevent you from working.

MedPay claims can be filed alongside your health insurance claim and can help reimburse expenses. This coverage can be accessed without any demonstration of fault. You can receive coverage for your medical bills. Unlike your insurance coverage, MedPay does not affect your insurance rates.

MedPay is not a mandatory insurance requirement in Virginia. But it is highly beneficial to have on your policy in the event of an accident.

If you have purchased MedPay as part of your policy and are involved in a collision, be sure to have a lawyer help you with your MedPay and health insurance claims to ensure you receive compensation and file both claims correctly.

Uninsured/Underinsured Motorist Coverage can Provide Medical Compensation When Hit by an Uninsured Driver

If you were hit by an uninsured driver, you will need to recover compensation through your own insurance company. While Virginia does not require it, uninsured motorist (UM) (§ 38.2-2206) and underinsured motorist (UIM) insurance coverage are valuable to have in situations like these. This coverage ensures that you can receive coverage for your medical bills and losses.

Uninsured motorist coverage covers your expenses when there is no other insurance to file your claim against. If the driver was underinsured, your coverage pays the difference between what the at-fault driver’s insurance will pay and the cost of your expenses.

These coverages pay for your medical bills in a Virginia car accident, as well as lost income and pain and suffering.

If an uninsured/underinsured driver hits you and does not have UM/UIM coverage, then you may need to file a personal injury claim instead to cover your medical bills. It could also leave you to pay for some of your medical expenses yourself.

MartinWren, P.C., Fights to Secure the Compensation You Need

MartinWren, P.C., is unrelenting in our pursuit of justice for you. We have served thousands of clients over 15–plus years in business. We understand how much financial strain medical bills can cause, and we work tirelessly to secure you the means to pay them.

Empowering you to reclaim your life is one of our top priorities, and our compassionate team works aggressively to secure maximum compensation allowed under the law.

Contact us today to schedule a free consultation so you can learn who pays your medical bills in a Virginia car accident.

Call (434) 817-3100 or complete a Case Evaluation form